You need to protect your family from potential financial losses that may occure, if somthing happened to you. If you have taken Life Insurance it will be a financial security to your family after you. It will help them pay off debts, medical expenses, living expenses and plan the future. Also Life Insurance is tax free returns few policies will help you can plan your expenses in near future. That is why Life Insurance is called as "Zindagi ke saath bhi Zindagi Ke Baad Bhi.".

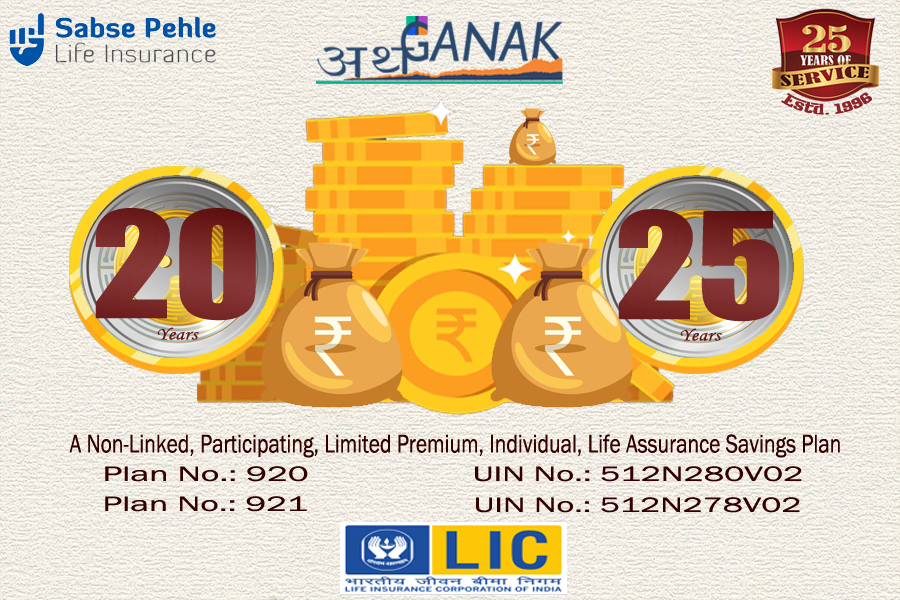

Life insurance is essential to plan long term fund creation with low or norisk. There are variety of investment plan which offers insurance and funds creation.